Do No Evil

What's more ironic is the fact that the Chineese Communist Party is now a successful real estate company! Hat tip to Brad Setser.

Nouriel Roubini on his encounter with Italy's Economy Minister:

Here is the post.

The SF Chronicle has an article on the growing popularity of solar panels in residential homes:

On his way to Davos Nouriel Roubini comes through with an excellent post:

Business Week has an excellent article on Cancer Drugs. Did you know that most insurers do NOT cover the use of cancer drugs for forms of cancer other than what they were approved for:

The Christian Science Monitor has an article on a new breed of investors who use a POSITIVE screening method:

Business Week has a nice article on my favorite record store:

Business Week has a nice article on my favorite record store:In a recent post, I raved about St. Anthony farm in Sonoma County: Common Ground magazine has an excellent profile in their January 2006 issue.

Washington Post columnist Steve Pearlstein, took questions from all comers: the resulting transcript is here. I encourage you to read through the discussion, it's a good primer on Healthcare and the politics of reforming it.

The SF Bay Guardian has an article on three new MBA programs who collectively have less than 300 students:

So says, management professor and guru C.K. Prahalad. Conventional thinking equates outsourcing with exporting white-collar and other professional jobs. Prahalad believes companies need to start importing innovative ideas to remain competitive. He sites many examples, including the IndiaOne Hotel:

NYTimes has a short article on Wendy Gordon, the founder and director of the Green Guide Institute. The article portrays her as performing " ... a balancing act between greenness and practicality".

Business Week has a cover article on the growing importance of Math/Stat and other quantitative techniques in a variety of industries:

A new NBER working paper confirms what we've been reading in the mainstream media:

I hope other states, especially California, follow suit:

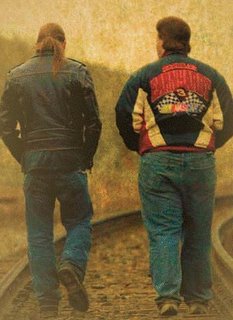

Frontline has done it again! This is an amazing series, can't say enough about it. Set in the Appalachian region of Kentucky, it follows two young men in their last three years of high school. You get a snapshot of rural white America, and the incredible challenges facing these young kids. An important part of the documentary is David School, the alternative school attended by both of the young men.

Frontline has done it again! This is an amazing series, can't say enough about it. Set in the Appalachian region of Kentucky, it follows two young men in their last three years of high school. You get a snapshot of rural white America, and the incredible challenges facing these young kids. An important part of the documentary is David School, the alternative school attended by both of the young men.The sad thing, is that things could get worse: like the dollar falling , and other things that can beset the US economy this year.

I just finished reading George Packer's new book on Iraq, and was very impressed with it. Packer is longtime correspondent for the New Yorker, and his book chronicles his extensive travels through Iraq over a 2-3 year period. The book is a rare combination of extensive conversations with average Iraqis, (in some cases) years of conversations with key members of the Iraqi exile movement, members of the neo-conservative faction in Washington, and American civilian and military personnel in Iraq and Washington. The book also chronicles the decision-making which led to the rise of the neo-cons and their incompetence at almost every key stage: from the decision to invade, to the bungled occupation of Iraq. George Packer is an excellent story-teller, just what you might expect from a New Yorker writer.

I just finished reading George Packer's new book on Iraq, and was very impressed with it. Packer is longtime correspondent for the New Yorker, and his book chronicles his extensive travels through Iraq over a 2-3 year period. The book is a rare combination of extensive conversations with average Iraqis, (in some cases) years of conversations with key members of the Iraqi exile movement, members of the neo-conservative faction in Washington, and American civilian and military personnel in Iraq and Washington. The book also chronicles the decision-making which led to the rise of the neo-cons and their incompetence at almost every key stage: from the decision to invade, to the bungled occupation of Iraq. George Packer is an excellent story-teller, just what you might expect from a New Yorker writer.The LATimes has a comprehensive article on the union headed by the late Cesar Chavez. For those of us who care about Fair Trade and working conditions EVERYWHERE, this article paints a grim picture of a union that was once one of the most closely watched social groups in the country.

Towns that meet a set of conditions can be certified as Fair Trade towns? I was not aware a group actually makes such a designation, then I saw this. What's the criteria you ask:

Rather than boycotting, or screening out potential investment opportunities:

Access to workers, suppliers, and universities outside their home countries is key:

The Golden State is by far the largest and most important automobile market in the U.S -- it accounts for about 10% of all vehicles sold nationally. The standards California adopts usually propagate to the rest of the country, I just was not expecting it to happen this fast:

Here are the movies recommended in my recent (Nov/Dec 2005) postings:

The Economist has a new article on the history and state of French views of the U.S.