Farm Subsidies May Derail Hongkong Round

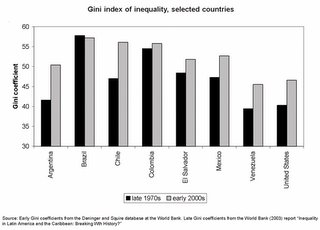

Farm subsidies are politically explosive on both sides of the Atlantic. In the US, either major party would find it hard to significantly rollback subsidies provided to say corn and rice farmers. Is it Free Trade, if developing countries have to go up against huge conglomerates, who are are highly subsidized and mechanized? Sure small farmers benefit from these subsidies, but I would venture that a bulk go to large agri businesses. Fortunately, both the US and EU are realizing this is an issue that the developing countries are going to be united on. How can developing countries be expected to open up their financial sevices, energy, and water sectors, in the name of the wonders of the Free Market, when our own farm sector is highly subsidized? Ultimately, these subsidies hurt the poorest countries: poor countries prefer Trade over AID. We can help our own small farmers by buying locally grown organic produce.

In a report to be released Wednesday, Oxfam International highlights three American commodity crops vulnerable to lawsuits and eight agricultural products in the European Union that could be sources of cases.

Several independent experts agree with Oxfam's assertion that complaints could be brought against the United States' corn, rice and sorghum programs, while the 25-country European Union could be challenged on subsidies for tomatoes, tobacco, butter, wine and spirits, citrus juices and processed fruits like canned peaches and pears.

According to the report, the subsidies for the 11 crops and products noted by Oxfam total $9.3 billion for the United States out of the country's $19.5 billion in subsidy payments, and $4.2 billion for the European Union out of $44.8 billion, on an annual basis.

Oxfam, a nongovernmental advocacy group involved in world poverty issues, has lobbied strenuously for rich countries to reduce agricultural subsidies so that developing countries in Africa and elsewhere can better compete and grow their economies. But several outside experts agree that more cases are likely if meetings of the World Trade Organization next month in Hong Kong do not produce a substantial agreement toward reducing so-called trade-distorting subsidies

Brazil's successful challenges to the European Union's sugar program and parts of the United States' cotton program have opened the door for more challenges before the W.T.O., trade experts say. The European Union unveiled an overhauled sugar program last week that cuts support prices 36 percent.

"Those cases point out some of the vulnerabilities that both the E.U. and the U.S. have with some of their present farm programs," said Clayton Yeutter, a former secretary of agriculture and United States trade representative. If negotiations do not produce progress, "it would not be surprising to see additional W.T.O. dispute settlement challenges of this nature," he said.

The talks in Hong Kong are part of a round of trade discussions that began in 2001 in Doha, Qatar. They were termed a "development round," meant to lift the world's poor nations out of poverty by giving their farmers better access to developed world markets.

American trade officials said on Tuesday that they could not comment on the accuracy of the Oxfam estimates, but that the United States is trying to eliminate the kinds of farm subsidies that could run afoul of the W.T.O. rules.